Timeliness of Tax Payments is Crucial for Permanent Residency Applications

One of the requirements for a permanent residency application is to be a person who "abides by the law and leads a socially irreproachable life as a resident in their daily life."

If you have paid your taxes after the payment deadline, you may not be considered to have met the above requirement, and there is a high possibility that your application for permanent residency will be denied.

In fact, one of the documents to be attached to the permanent residency application is a "document proving that resident taxes have been paid at the appropriate time (e.g., a copy of a bank book)."

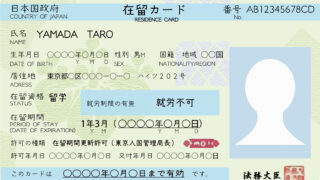

For those with a work visa such as an "Engineer/Specialist in Humanities/International Services," five years of tax payment records are required. If you have paid your taxes after the deadline within this five-year period, your permanent residency application will be denied.

If you are considering applying for permanent residency and are concerned about meeting the requirements, please do not hesitate to consult our office.

投稿者プロフィール

最新の投稿

Permanent Resident02/23/2026When an Application for Permanent Residency is Denied

Permanent Resident02/23/2026When an Application for Permanent Residency is Denied Visa02/16/2026Procedures for Foreign Residents When a Child is Born in Japan

Visa02/16/2026Procedures for Foreign Residents When a Child is Born in Japan Business Manager02/09/2026Understanding the "30 Million Yen Total Wealth" Requirement for the "Business Manager" Status

Business Manager02/09/2026Understanding the "30 Million Yen Total Wealth" Requirement for the "Business Manager" Status Naturalization02/02/2026Important Considerations for Naturalization Applications

Naturalization02/02/2026Important Considerations for Naturalization Applications